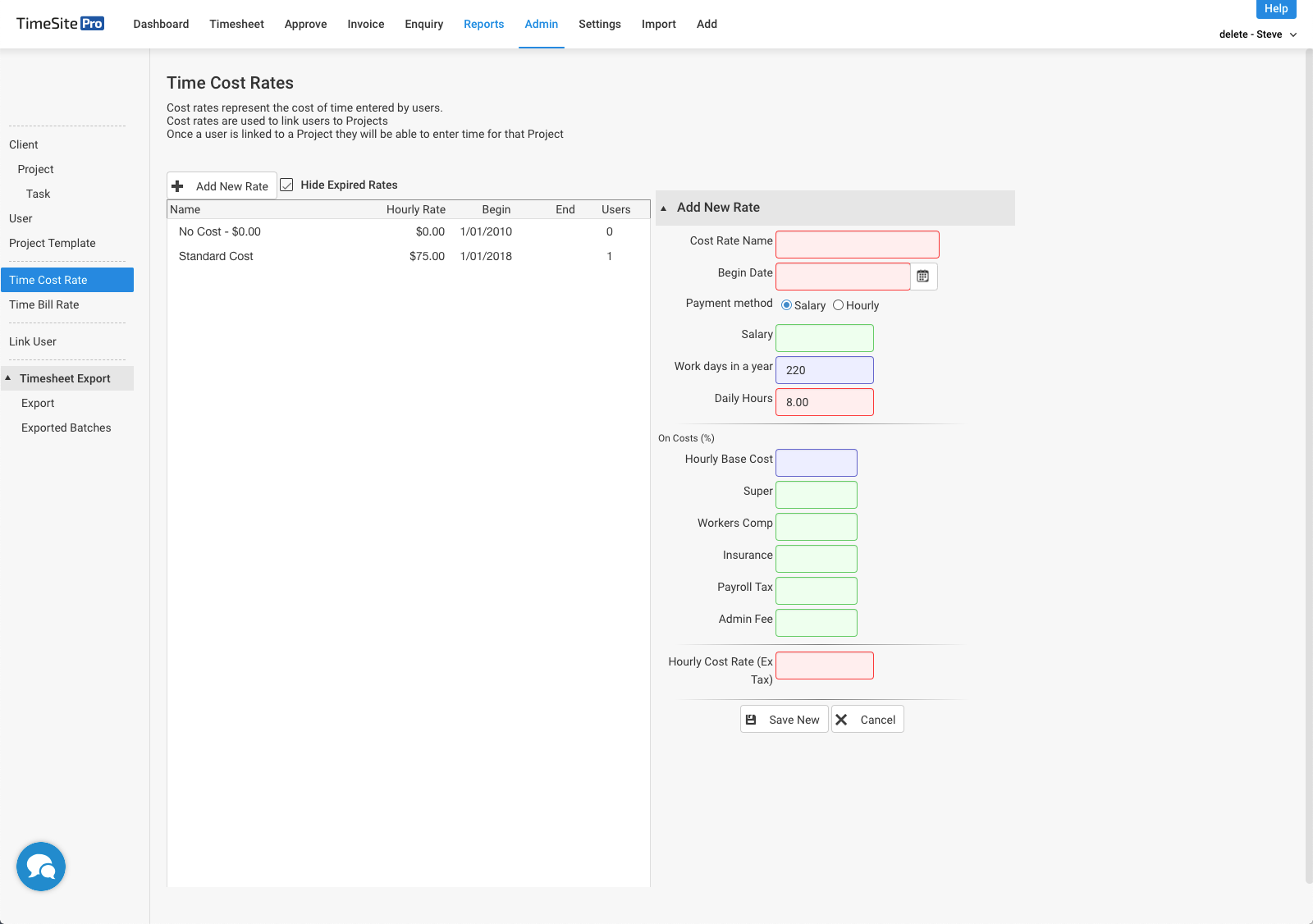

TimeSite Pro enables you to calculate the cost of work performed on your client's projects as well as the cost of internal and staff work performed. Cost rates can be specified for users, projects and individual tasks. Time cost rates can be calculated from either salary, daily or hourly payments and can include employment overheads such as superannuation and workers compensation.

If you are specifying a cost rate based on a user's salary, the hourly cost will be calculated using the number of working days in the year (typically 220 days) and the number of working hours in the day (typically 8 hours). These values can be modified in Settings > System Settings > Rates > Time Worked and Cost Rates.

Time cost rates can be updated as of an effective date, and cost rates can have an End Date after which the rate won't be applied to timesheet records.

Note that links between users and projects specify the cost rate (and bill rate) that applies to the work done by the user on a project. The cost rate effective data range is used to track the correct rate to be applied to work performed depending on the date of the timesheet record. Therefore, cost rates cannot be deleted once they are used to specify the cost rate in a timesheet record.

Refer to Project-User Linking: Standard & Accounting Subscription and Project-User Linking: Basic Subscription for information on how to link users to projects.

If you specify User Cost Rate in a project (Project > Finance panel) or task (Task > Finance panel), then the cost rate specified in the User record will be used when calculating the cost of work performed for a project or task.

The cost to be calculated for a timesheet record is calculated by applying the cost rate to the Actual Hours (Total duration less Break duration). The Actual Hours used for the cost calculation may be different to the Billable Hours used to calculate billable revenue for the timesheet record.

Comments

0 comments

Please sign in to leave a comment.