TimeSite Pro supports both invoice write-offs and bad debt processing.

Invoice Write-off

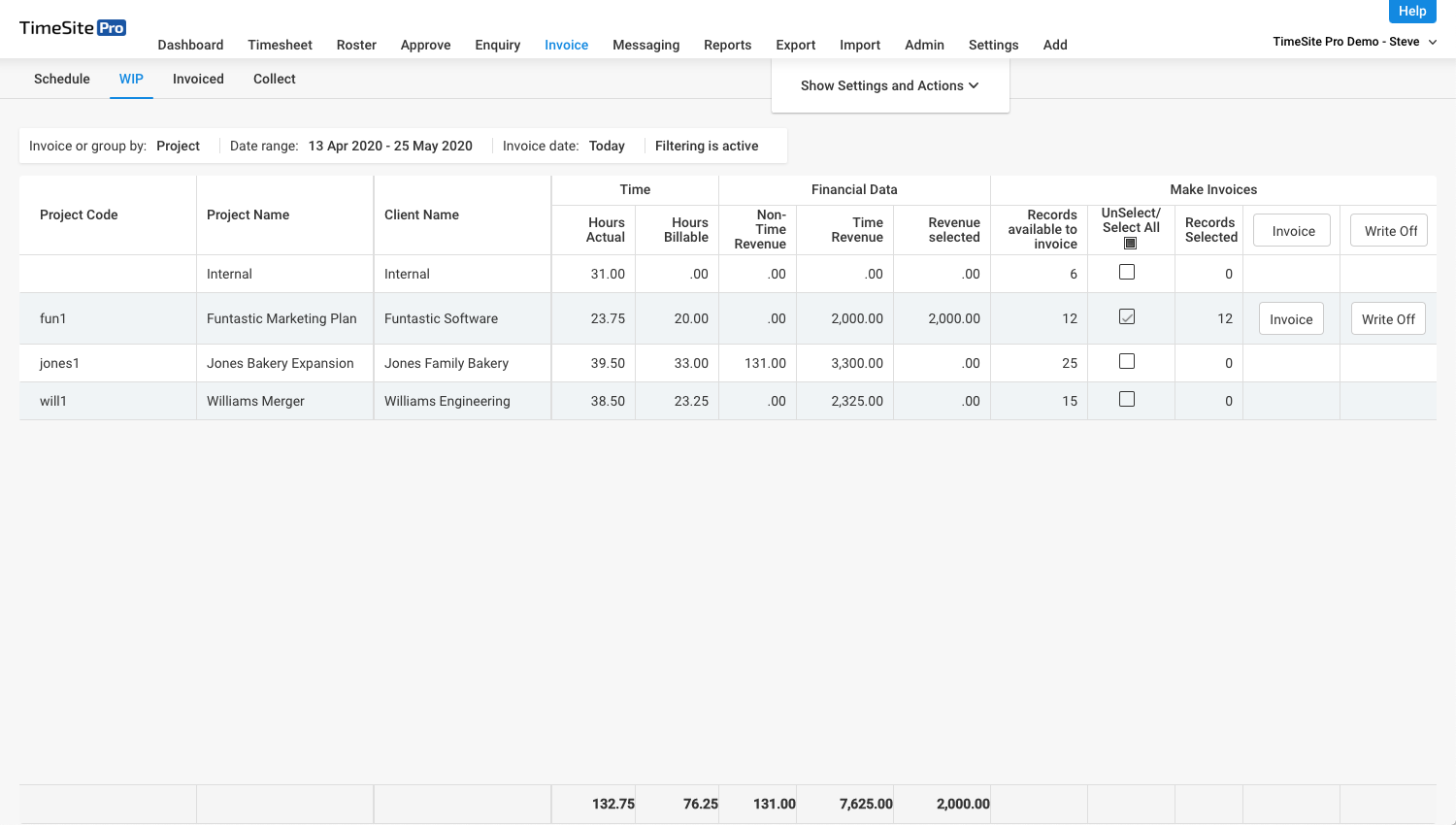

You can write-off billable work performed rather than creating an invoice in the Invoice > WIP screen. Select for the client or project to be written off or drill down to a specific client or project and select the individual timesheet records to be written off.

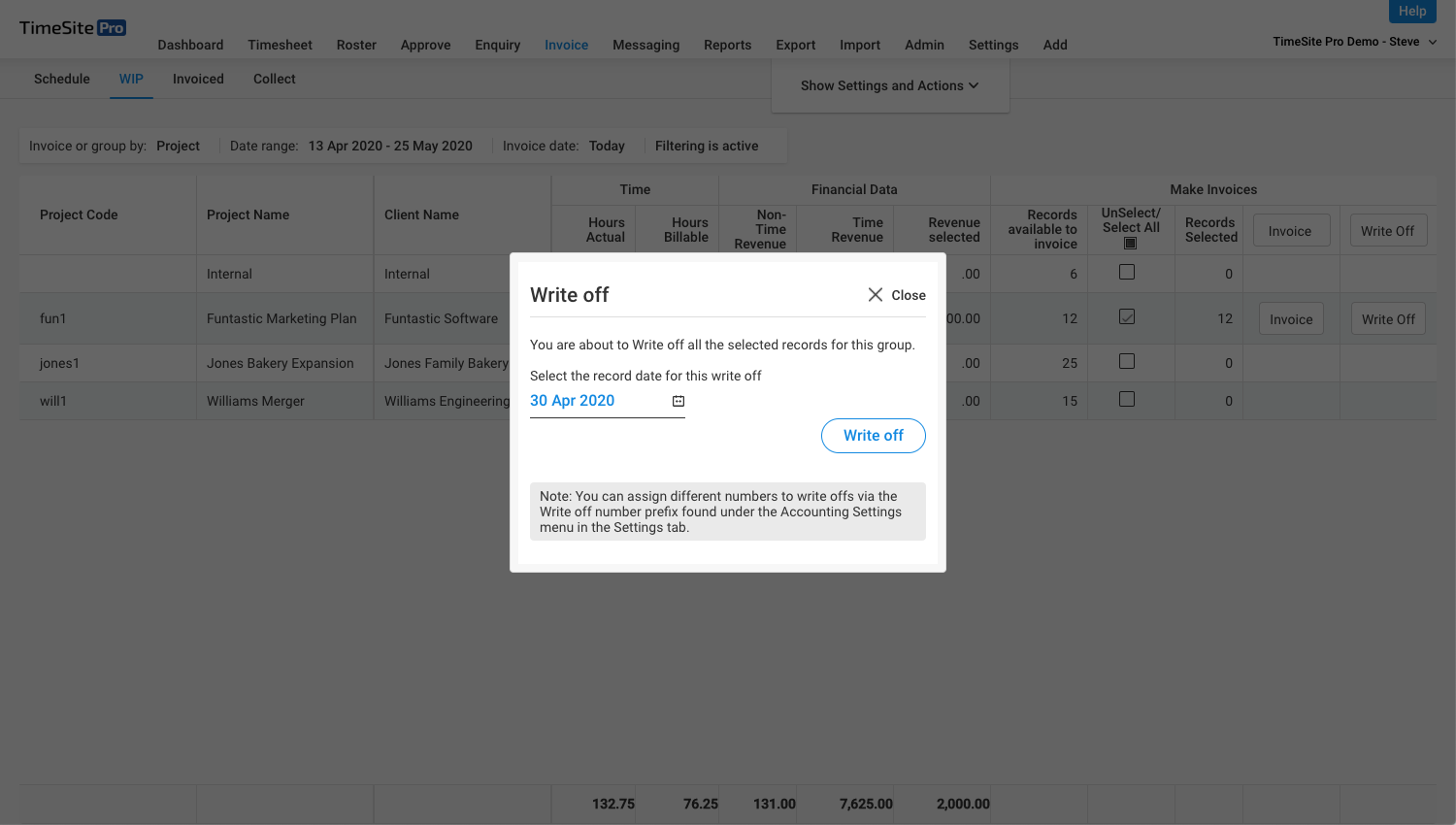

Click on Write Off and confirm the date for the write-off transaction. Then click on Write Off to confirm the action.

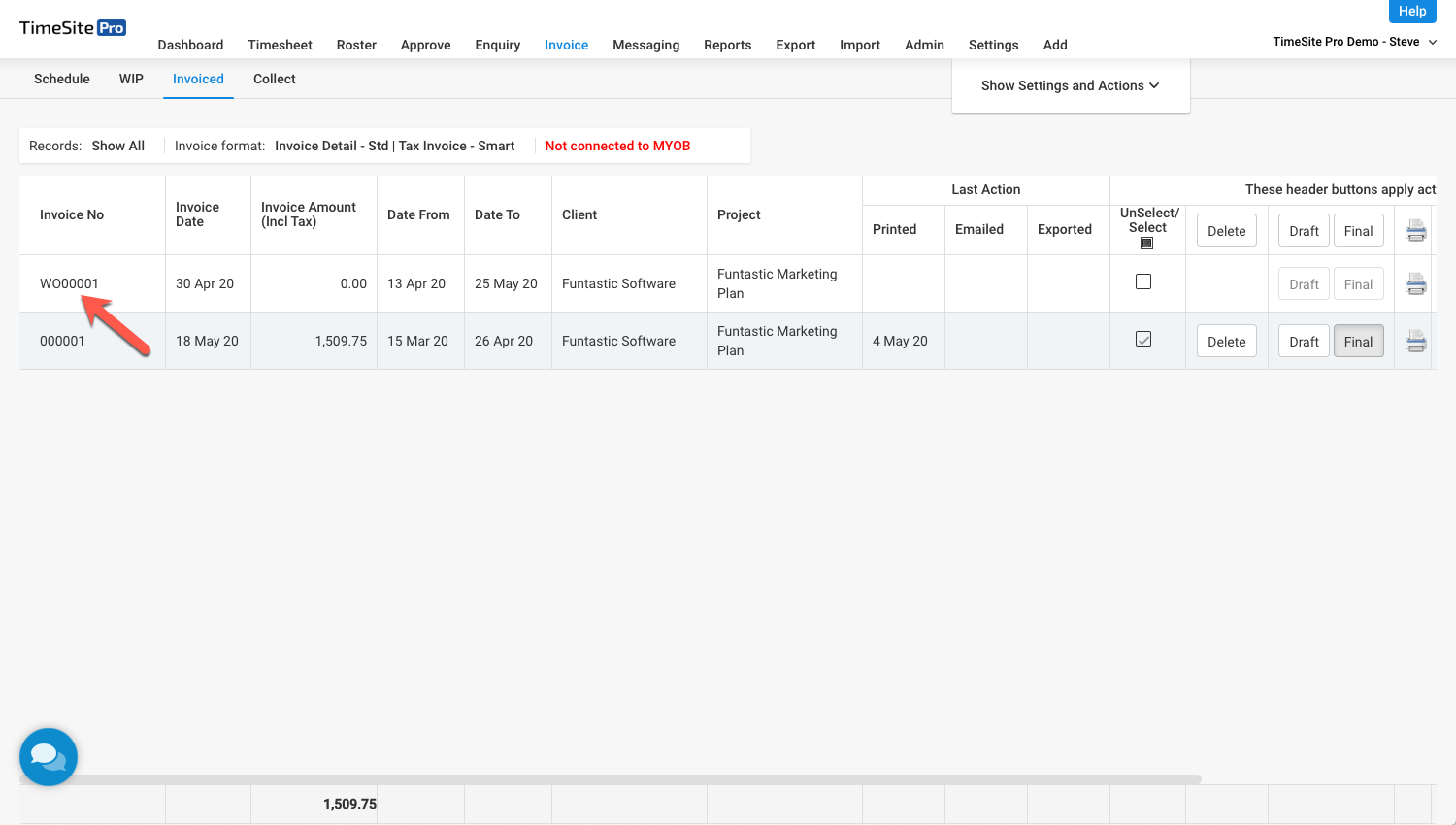

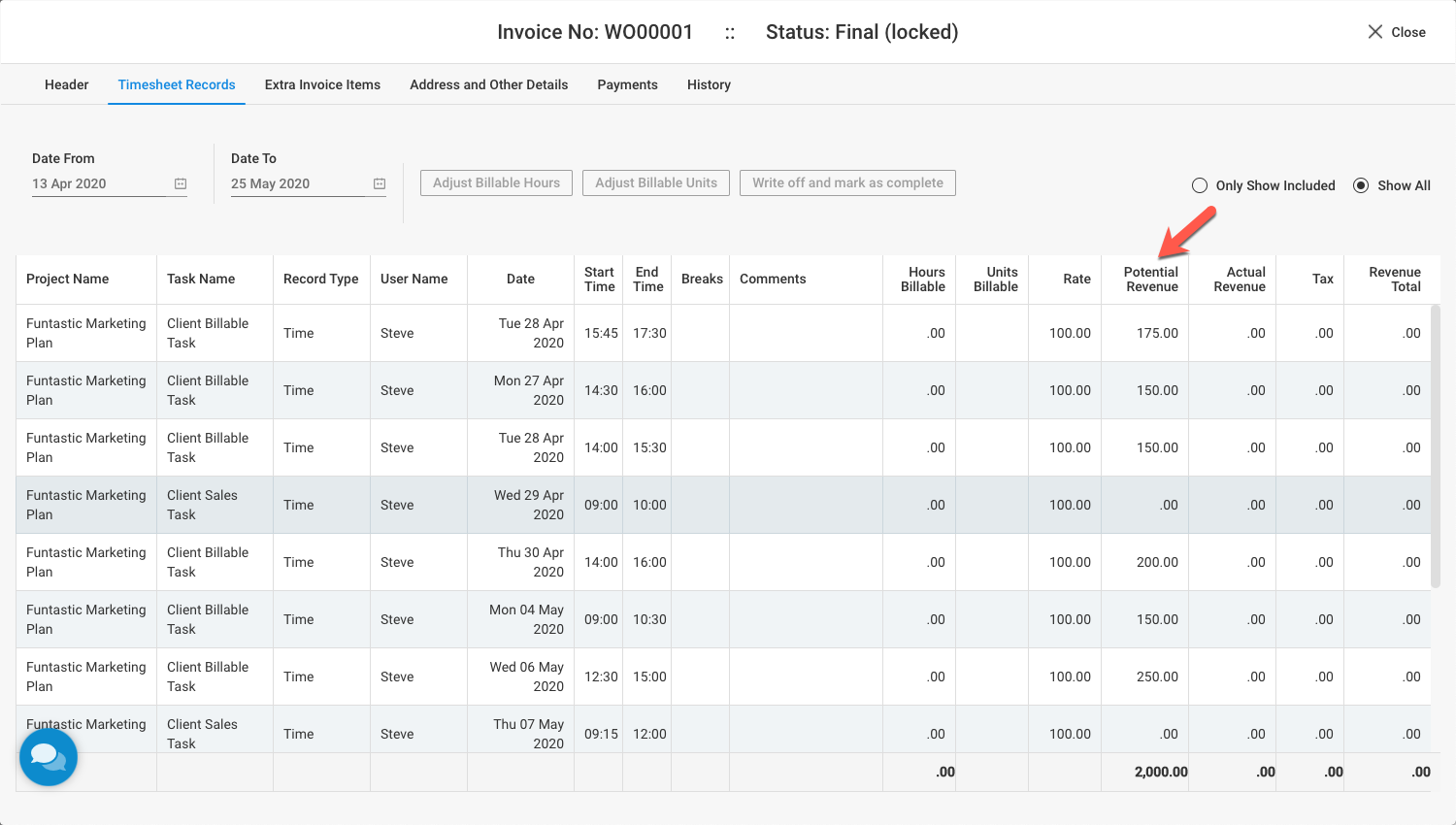

TimeSite Pro creates a "write off" invoice where the invoice number is prefixed with "WO". This prefix can be changed in Settings > Accounting > Accounting Settings > General Settings > Write off number prefix. The written-off invoice is visible in the Invoice > Invoiced screen by showing all (including Completed) invoices in the Show Settings and Actions pulldown. These invoices are identified by the "WO" prefix.

Note that the revenue value of the write-off invoice is zero, but we track the Potential Revenue value of the work performed and, therefore, the Revenue Loss value for reporting purposes.

Bad Debts

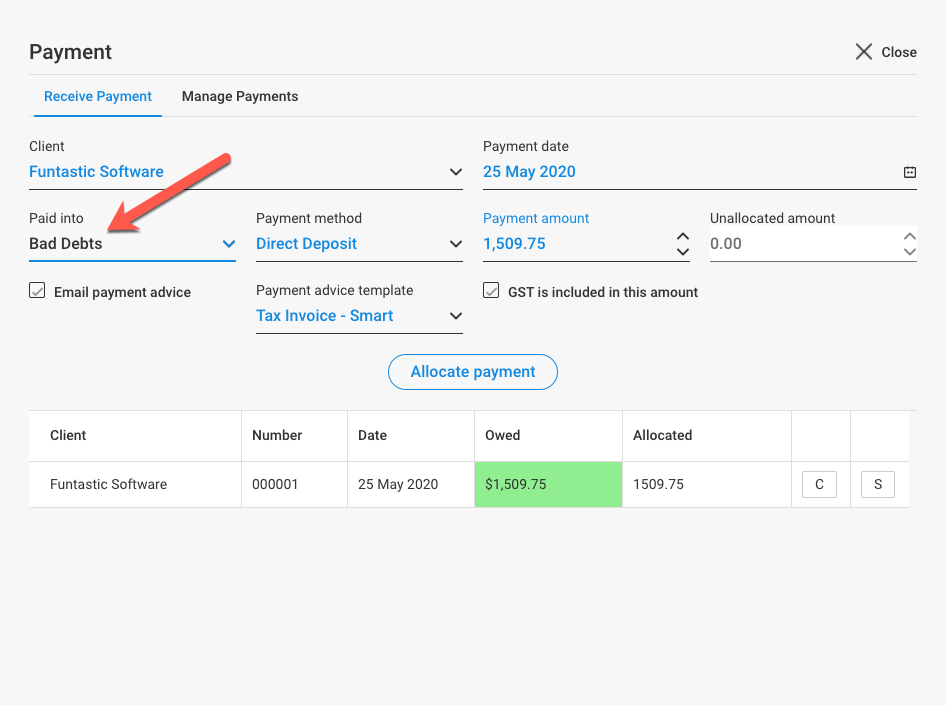

In the event that an invoice has been raised but you subsequently identity that the invoice will not be paid in whole or part, you can write off this unpaid value of the invoice to your bad debt account in the Invoice > Collect screen. You can specify Bad Debt as a Payment Account in Settings > Accounting > Payment Accounts.

Accounting Settings

Go to Settings > Accounting to configure your write-off and bad debt settings. See Settings - Accounting for more information.

Comments

0 comments

Article is closed for comments.