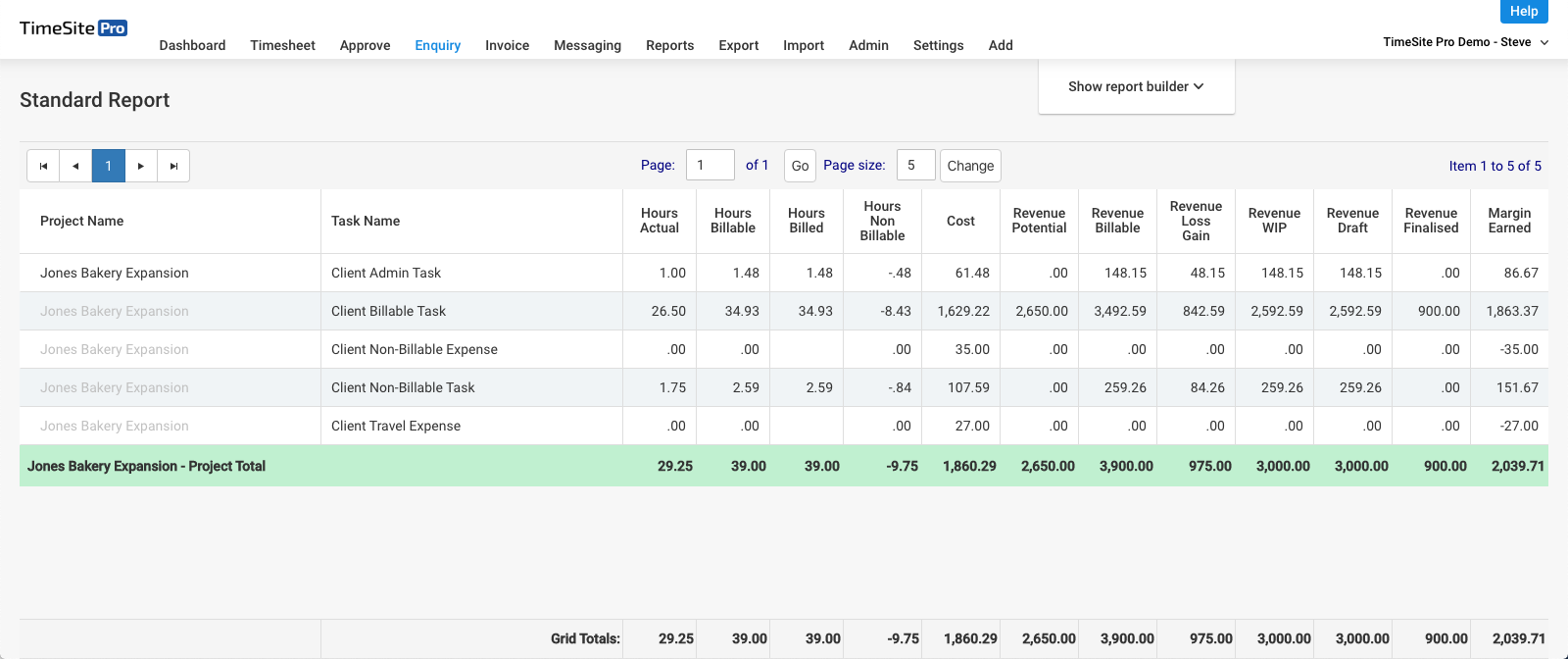

TimeSite Pro keeps track of a number of revenue data fields that track to the different stages of the billing process as well as any billable adjustments. You can report on these revenue fields in the Enquiry screen. Here is an example.

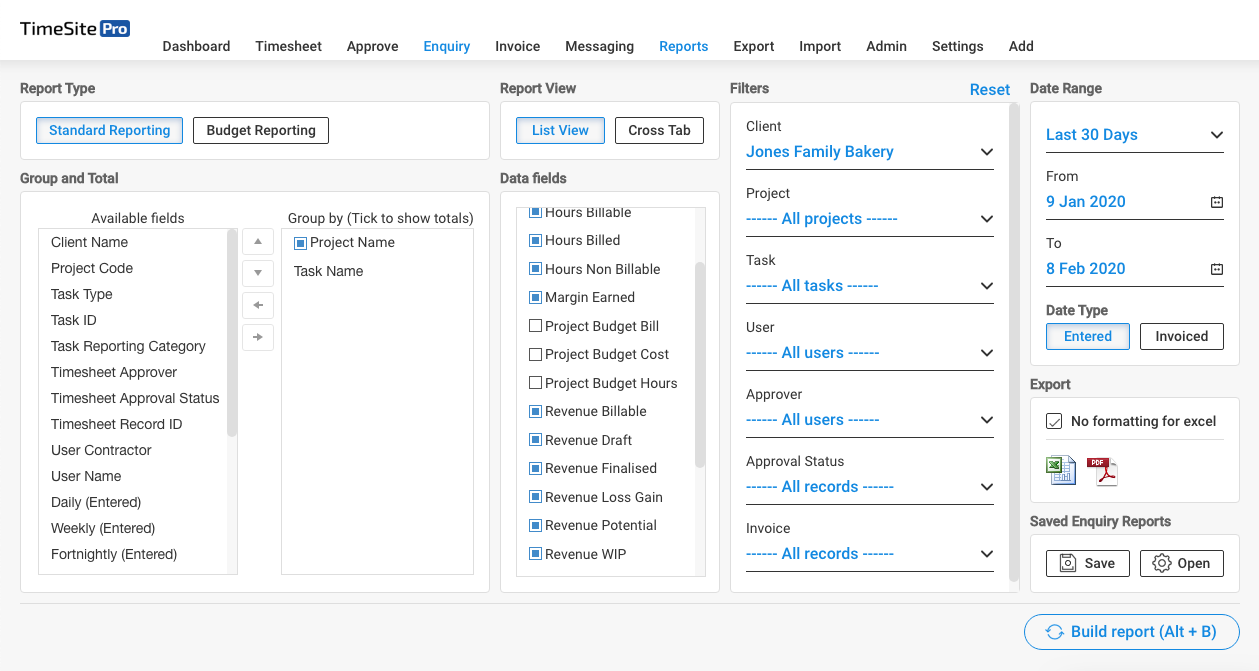

This Enquiry report was specified in the report builder this way.

The following data fields have been selected in this Enquiry report.

- Hours Actual: the number of hours spent on the task, this will be used to calculate the cost of this task.

- Hours Billable: the number of hours to be billed to the client; this figure may be different from the Hours Actual and will be zero if the task is not to be billed to the client. This figure is shown in the Timesheet summary table as Potential revenue hours.

- Hours Billed: the number of hours that were actually billed to the client; this may be more or less than the Hours Billable or it may be zero. This is shown in the Timesheet summary table as Billable hours.

- Hours Non-Billable: the number of hours that are not to be billed to the client for some reason.

- Cost: Hours Actual x Cost Rate.

- Revenue Potential: the revenue calculated using the Actual Hours & Actual Units x Bill rates. Note that the Revenue Potential is not necessarily the same has Revenue Billable. If the activity is designated as non-billable, then we have forgone the revenue value of this activity. The Revenue Billable is zero and the Revenue Loss/Gain is negative showing that we have foregone this revenue "opportunity" (aka potential).

- Revenue Billable: the revenue calculated using the Hours Billed & Units Billed x Bill rates; that is, the billable revenue after any adjustments. Note that Hours Billed is not necessarily the same as Hours Billable.

- Revenue Loss/Gain: the difference between the Revenue Billable and the Revenue Potential; that is, the revenue foregone or adjusted. This value will be negative if you have decided not to bill (in full or in part) the revenue opportunity of this activity.

- Revenue WIP: the revenue not yet invoiced either as draft or finalised.

- Revenue Draft: the revenue from invoices in the draft status.

- Revenue Finalised: the revenue from invoices that have been finalised, ready to be sent to the client. This can also be defined as "Revenue Billed", i.e. the revenue actually billed to the client after all adjustments.

- Margin Earned: the difference between the Revenue Billable and Cost, that is, gross margin on the project or task.

Review the help article What do the different budget numbers mean? for more information on these additional data fields available in the Enquiry report builder.

Comments

0 comments

Please sign in to leave a comment.